[mk_page_section bg_image=”https://www.equitymax.com/wp-content/uploads/2016/11/loan-programs-hero-bg.jpg” bg_repeat=”no-repeat” bg_stretch=”true” video_color_mask=”#000000″ video_opacity=”0.8″ padding_top=”100″ padding_bottom=”100″ sidebar=”sidebar-1″]

[mk_padding_divider size=”160″ visibility=”hidden-nb”][mk_fancy_title tag_name=”h1″ color=”#ffffff” size=”40″ font_weight=”300″ font_family=”none” align=”center”]A RELIABLE LENDER WITH AN EMPIRE STATE OF MIND[/mk_fancy_title][mk_fancy_title tag_name=”span” color=”#ffffff” size=”22″ line_height=”160″ font_weight=”300″ font_family=”none” align=”center”]Financing options have never been more plentiful in New York, where the real estate investment landscape is endless. When comparing hard money options, EquityMax sets itself apart with 30 years of experience as a family owned-and-operated business that provides first-class customer care. Whether you speak with the owners directly or a friendly member of our team, we have the insight and know-how to help your real estate investment business grow to new heights.[/mk_fancy_title]

[/mk_page_section][mk_page_section bg_color=”#f6f6f6″ padding_top=”30″ padding_bottom=”30″ el_class=”trust-signals” sidebar=”sidebar-1″]

[/mk_page_section][mk_page_section bg_color=”#ffffff” padding_top=”60″ padding_bottom=”60″ sidebar=”sidebar-1″]

[mk_fancy_title size=”40″ txt_transform=”uppercase” font_family=”none” align=”center”]Customized Hard Money Options For Your Next Project in New York

[/mk_fancy_title]

[mk_icon_box2 icon_size=”32″ icon=”mk-moon-rocket” icon_color=”#ffffff” icon_background_color=”#006989″ title=”SPEEDY CLOSINGS”]EquityMax cuts the red tape and qualification requirements for every borrower. Minimal documentation and quick communication enables us to close your deal within 24 hours from receipt of title.[/mk_icon_box2]

[mk_icon_box2 icon_size=”32″ icon=”mk-icon-cubes” icon_color=”#ffffff” icon_background_color=”#006989″ title=”WE WORK WEEKENDS”]Being a successful real estate investor is a 24/7/365 operation. EquityMax understands this and offers hands-on insights with a single phone call. Whenever you have questions, we have answers.[/mk_icon_box2]

[mk_padding_divider size=”20″]

[mk_icon_box2 icon_size=”32″ icon=”mk-icon-thumbs-o-up” icon_color=”#ffffff” icon_background_color=”#006989″ title=”WE INVEST WHERE YOU INVEST”]New York is a diverse setting with multiple avenues to be a successful real estate investor. Whether it’s in the Big Apple or Upstate, EquityMax will finance your next real estate endeavor.[/mk_icon_box2]

[mk_icon_box2 icon_size=”32″ icon=”mk-icon-expand” icon_color=”#ffffff” icon_background_color=”#006989″ title=”MORE DEALS / BETTER TERMS”]EquityMax welcomes the opportunity to build long-lasting relationships with real estate investors, whether new or seasoned. With each successive deal, you can always expect lower interest rates and higher LTVs.[/mk_icon_box2]

[/mk_page_section][mk_page_section bg_color=”#154b62″ padding_top=”40″ padding_bottom=”40″ el_class=”cta-strip” sidebar=”sidebar-1″]

[mk_fancy_title tag_name=”span” color=”#ffffff” size=”24″ font_weight=”300″ txt_transform=”uppercase” letter_spacing=”1″ font_family=”none” align=”right”]

CLOSE IN 48 HOURS OR LESS! READY TO GET STARTED ON YOUR NEXT DEAL IN NEW YORK?

[/mk_fancy_title][mk_button dimension=”flat” corner_style=”full_rounded” size=”large” url=”https://www.equitymax.com/apply-for-a-loan/” align=”center” margin_right=”0″ bg_color=”#ffffff” btn_hover_bg=”#85bbd2″ text_color=”dark” btn_hover_txt_color=”#ffffff”]APPLY FOR A LOAN[/mk_button]

[/mk_page_section][mk_page_section bg_color=”#f6f6f6″ padding_top=”40″ padding_bottom=”20″ el_class=”selling-points” sidebar=”sidebar-1″]

[mk_fancy_title color=”#154b62″ size=”26″ txt_transform=”uppercase” margin_bottom=”0″ font_family=”none” align=”center”]Latest Success Story[/mk_fancy_title]

A new investor had initially purchased a primary residence years back, but now was living in a different home, and renting her previous residence out. Between renting it out and when the borrower inquired about a loan, the market price for her investment property skyrocketed. Once that tenant no longer occupied the unit, the borrower was looking to pull cash out of her now-rental property to make some improvements and then ultimately sell the property.

[mk_padding_divider size=”19″][mk_table]

| REFI, FIX AND FLIP |

| Location – Gansevoort, NY |

| Loan Amount – $75,000 |

| Purchase Price – $85,000 |

| Loan Type – Purchase |

| Term – 12 Months – 17 years (Borrower Option) |

| Rehab Amount – $50,000 |

| Actual Retail Value – $250,000 |

| Profit – $115,000 |

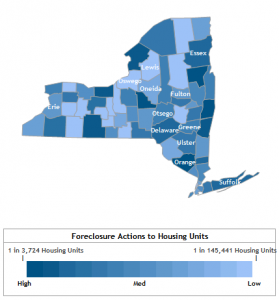

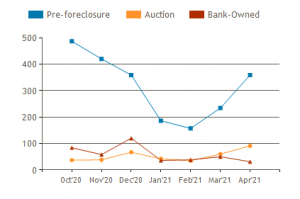

[/mk_table][mk_padding_divider size=”19″][mk_fancy_title color=”#154b62″ size=”26″ txt_transform=”uppercase” margin_bottom=”0″ font_family=”none” align=”center”]Real Estate Breakdown of New York[/mk_fancy_title][mk_padding_divider size=”19″]

[mk_padding_divider size=”19″]

New York state is known around the world for its real estate. With New York City in the center and growing areas like Buffalo, Albany, and Rochester scattered throughout, there are plenty of opportunities for investors to take advantage of. This particular investor has purchased a property in previously distressed condition and now needed to perform repairs and sell it. EquityMax saw that there was a niche opportunity in this small town for the borrower to sell her previously underpriced property for a massive profit. We subsequently provided easy financing to ensure her dream became a reality.

[mk_fancy_title color=”#154b62″ size=”26″ txt_transform=”uppercase” margin_bottom=”0″ font_family=”none” align=”center”]Driving Factors for New York Real Estate Market[/mk_fancy_title][mk_custom_list style=”mk-moon-checkmark-circle-2″ icon_color=”#2ecc71″]

-

Popularization of Urban Suburbs

Millennials are moving at a high rate to metropolitan suburban areas like Westchester and even across Long Island, where new neighborhoods are emerging that combine the best attributes of urban and suburban lifestyles. As a result, they make highly profitable investment opportunities for those in real estate.

-

Rental Prices

Vacancy rates are decreasing as rental housing has increased in demand, especially during the summer months. Moreover, new rental units have been appearing rapidly throughout the state and the new boost in supply has forced landlords to price their properties more competitively and offer better concessions.

-

Strong Home Buyer Activity

Like much of the country, real estate is in high demand across New York as homebuyers are breaking previous records. This generally makes New York state a more stable investment market.

[/mk_custom_list][mk_padding_divider size=”10″][mk_fancy_title color=”#154b62″ size=”26″ txt_transform=”uppercase” margin_bottom=”0″ font_family=”none” align=”center”]Foreclosure Filings For New York[/mk_fancy_title][mk_padding_divider size=”10″]

[mk_padding_divider size=”19″]

[/mk_page_section][mk_page_section bg_color=”#ffffff” padding_top=”60″ padding_bottom=”60″ el_class=”home-testimonials” sidebar=”sidebar-1″]

[mk_fancy_title color=”#0a0a0a” size=”40″ txt_transform=”uppercase” margin_bottom=”0″ font_family=”none” align=”center”]What Our Clients Say[/mk_fancy_title][mk_testimonials count=”1″ text_color=”#999999″ font_weight=”300″ testimonials=”5432″]

[/mk_page_section][mk_page_section bg_color=”#f6f6f6″ padding_top=”40″ padding_bottom=”20″ el_class=”selling-points” sidebar=”sidebar-1″]

[mk_padding_divider][mk_fancy_title color=”#154b62″ size=”26″ txt_transform=”uppercase” margin_bottom=”0″ font_family=”none” align=”center”]FIX AND FLIP / CASH-OUT REFI[/mk_fancy_title][mk_custom_list style=”mk-moon-checkmark-circle-2″ icon_color=”#2ecc71″]

[/mk_custom_list]

[mk_padding_divider][mk_fancy_title color=”#154b62″ size=”26″ txt_transform=”uppercase” margin_bottom=”0″ font_family=”none” align=”center”]FOREIGN NATIONAL LOANS[/mk_fancy_title][mk_custom_list style=”mk-moon-checkmark-circle-2″ icon_color=”#2ecc71″]

-

ZERO Credit or Qualification Requirements

-

No Personal Guarantee Required

-

Free Comparable and Repair Analysis

[/mk_custom_list]

[mk_image src=”https://www.equitymax.com/wp-content/uploads/2016/11/transactional-funding-2.png” image_size=”medium” align=”center” visibility=”hidden-sm” el_class=”uggo”][mk_padding_divider][mk_fancy_title color=”#154b62″ size=”26″ txt_transform=”uppercase” margin_bottom=”0″ font_family=”none” align=”center”]TRANSACTIONAL FUNDING[/mk_fancy_title][mk_custom_list style=”mk-moon-checkmark-circle-2″ icon_color=”#2ecc71″]

[/mk_custom_list]

[mk_circle_image src=”https://www.equitymax.com/wp-content/uploads/2016/11/non-recourse-lending.jpg” image_diameter=”200″ visibility=”hidden-sm” el_class=”uggo”][mk_padding_divider][mk_fancy_title color=”#154b62″ size=”26″ txt_transform=”uppercase” margin_bottom=”0″ font_family=”none” align=”center”]NON-RECOURSE LENDING[/mk_fancy_title][mk_custom_list style=”mk-moon-checkmark-circle-2″ icon_color=”#2ecc71″]

[/mk_custom_list]

[/mk_page_section][mk_page_section bg_color=”#154b62″ js_vertical_centered=”true” padding_top=”40″ padding_bottom=”40″ sidebar=”sidebar-1″]

[mk_fancy_title strip_tags=”true” color=”#ffffff” size=”24″ font_weight=”300″ txt_transform=”uppercase” letter_spacing=”1″ font_family=”none” align=”center”]

Receive immediate pre-qualification within 10 minutes!

[/mk_fancy_title][mk_button dimension=”flat” corner_style=”full_rounded” size=”large” url=”https://www.equitymax.com/prequalify-now/” align=”center” margin_right=”0″ bg_color=”#85bbd2″ btn_hover_bg=”#ffffff” text_color=”dark” btn_hover_txt_color=”#0e4c60″]PREQUALIFY NOW[/mk_button]

[/mk_page_section][mk_page_section bg_color=”#ffffff” padding_top=”60″ padding_bottom=”60″ el_class=”home-testimonials” sidebar=”sidebar-1″]

[mk_fancy_title size=”40″ txt_transform=”uppercase” margin_bottom=”0″ font_family=”none” align=”center”]Did You Know?[/mk_fancy_title]

Several EquityMax clients, who are currently in Florida, have previously lived and invested in the Empire State. Given the rising market climate in the Sunshine State, EquityMax has gained several new borrowers who are New York Transplants.

[/mk_page_section][mk_page_section bg_color=”#f6f6f6″ padding_top=”60″ padding_bottom=”60″ sidebar=”sidebar-1″]

[mk_fancy_title size=”40″ txt_transform=”uppercase” font_family=”none” align=”center”]Frequently Asked Questions[/mk_fancy_title][mk_faq sortable=”false” faq_cat=”tennessee, new-york”]

[/mk_page_section]

[mk_fancy_title size=”40″ txt_transform=”uppercase” font_family=”none” align=”center”]Contact Us[/mk_fancy_title][gravityform id=”45″ title=”false” description=”false” ajax=”false”]